Payroll Meaning - A Comprehensive Guide To Understanding Employee Compensation

Payroll meaning can seem like a straightforward term, yet it carries immense weight in the world of business and employee relations. For most people, payroll represents the backbone of financial stability, ensuring that hard work is rewarded with fair compensation. Whether you're a small business owner or an HR professional, understanding payroll meaning is essential for managing your workforce effectively. But what exactly does payroll entail, and how does it impact both employers and employees alike? Let's explore the ins and outs of this critical process.

At its core, payroll meaning revolves around the act of compensating employees for their labor. This involves not just the calculation of wages but also handling taxes, deductions, and other financial obligations. For many businesses, payroll can become a complex task, requiring careful attention to detail and compliance with various regulations. Yet, despite its challenges, payroll remains one of the most rewarding aspects of running a business, ensuring that employees are fairly compensated for their efforts.

Understanding payroll meaning goes beyond just crunching numbers. It involves knowing how to manage employee expectations, stay compliant with legal requirements, and leverage technology to streamline processes. As we delve deeper into this topic, you'll discover practical insights, tips, and best practices to help you master payroll management. So, let's get started by breaking down the basics of payroll and its importance in today's business environment.

Table of Contents

- What is Payroll Meaning Exactly?

- How Does Payroll Work in Business?

- Why is Payroll Important for Employees?

- How Often Should Payroll Be Processed?

- What Are Some Common Payroll Deductions?

- Should You Outsource Payroll Management?

- What Tools Can Help Simplify Payroll?

- What Does Payroll Meaning Include Beyond Salary?

What is Payroll Meaning Exactly?

Let's start with the basics. Payroll meaning refers to the process of paying employees for their work. This includes tracking hours worked, calculating wages, and ensuring that all necessary deductions are taken care of. In a way, payroll acts as the bridge between an employee's effort and their financial reward. But payroll meaning doesn't stop there. It also involves managing various aspects such as taxes, benefits, and even contractor payments.

For instance, payroll meaning can vary depending on the industry or company size. A small business might handle payroll manually, while a larger corporation might rely on sophisticated software to automate the process. In fact, many businesses choose to outsource payroll to third-party providers, freeing up time for more strategic tasks. So, in some respects, payroll meaning extends beyond just paying employees—it's about ensuring compliance, accuracy, and efficiency in financial management.

How Does Payroll Meaning Relate to Compensation?

When we talk about payroll meaning, compensation is a big part of the equation. Compensation isn't just about salary—it includes bonuses, overtime pay, and other forms of remuneration. For example, if an employee works extra hours, payroll meaning ensures that they receive the appropriate overtime pay. Similarly, if an employee qualifies for a performance bonus, payroll meaning guarantees that this is accurately reflected in their paycheck.

Payroll meaning also involves handling statutory payments and deductions. These include taxes like social security and Medicare, as well as other mandatory contributions such as pension funds or health insurance premiums. In short, payroll meaning covers a wide range of financial obligations, ensuring that both employers and employees meet their responsibilities.

What Does Payroll Meaning Include Beyond Salary?

Payroll meaning isn't limited to just the amount of money an employee takes home. It also encompasses the process of collecting necessary information from employees, such as tax forms and benefit elections. For instance, when a new employee joins a company, payroll meaning requires gathering their personal details and setting up their account in the payroll system. This ensures that everything from taxes to health benefits is properly accounted for.

Additionally, payroll meaning involves maintaining accurate records of employee work hours and earnings. This is especially important for businesses that operate in industries where employees work irregular schedules or are paid by the hour. By keeping detailed records, businesses can ensure that employees are paid correctly and that any discrepancies are quickly resolved. So, payroll meaning is really about creating a transparent and reliable system for managing employee compensation.

How Does Payroll Work in Business?

Now that we've covered the basics, let's dive a little deeper into how payroll works in a business setting. First, businesses need to establish a payroll cycle, which is the frequency at which employees are paid. Common payroll cycles include weekly, bi-weekly, semi-monthly, and monthly. For example, a company might choose to pay its employees every two weeks to align with their budgeting needs.

Once the payroll cycle is set, businesses must track employee hours and calculate their earnings. This involves considering factors such as hourly rates, overtime, and any bonuses or commissions. Then, the business must account for various deductions, including taxes, health insurance premiums, and retirement contributions. Finally, the net pay is distributed to employees, either through direct deposit or physical checks. So, payroll meaning in a business context involves a series of steps to ensure accurate and timely payment.

Why is Payroll Important for Employees?

For employees, payroll meaning represents more than just a paycheck—it's a reflection of their value to the company. Accurate and timely payment is crucial for maintaining trust and morale within the workforce. After all, employees rely on their paychecks to cover essential expenses such as rent, groceries, and utilities. Any delays or errors in payroll can lead to frustration and dissatisfaction.

Beyond financial stability, payroll meaning also ensures that employees receive the benefits they're entitled to. This includes health insurance, retirement plans, and paid time off. By managing payroll effectively, businesses can demonstrate their commitment to employee well-being and create a positive workplace culture. So, payroll meaning plays a vital role in fostering a strong employer-employee relationship.

How Often Should Payroll Be Processed?

The frequency of payroll processing depends on several factors, including industry standards and employee preferences. For example, some businesses prefer to pay their employees weekly, especially in industries where workers are paid by the hour. On the other hand, salaried employees might receive their paychecks on a monthly or semi-monthly basis. It's important for businesses to establish a consistent payroll schedule that meets the needs of both employees and the company.

That said, businesses must also consider the administrative burden of processing payroll too frequently. Each payroll cycle requires gathering data, calculating earnings, and handling deductions, which can be time-consuming. So, finding the right balance is key to ensuring efficiency and accuracy. In some cases, businesses might opt for automated payroll systems to streamline the process and reduce errors.

What Are Some Common Payroll Deductions?

When it comes to payroll meaning, deductions play a significant role in determining an employee's net pay. Common deductions include federal and state income taxes, Social Security taxes, and Medicare taxes. These are mandatory contributions that both employers and employees must make to support public programs. Additionally, businesses might deduct amounts for health insurance premiums, retirement contributions, and other voluntary benefits.

For example, an employee might choose to contribute a portion of their paycheck to a 401(k) retirement plan. This deduction is typically taken out pre-tax, reducing the employee's taxable income. Similarly, businesses might offer flexible spending accounts (FSAs) for healthcare expenses, which also involve payroll deductions. So, payroll meaning involves managing a variety of deductions to ensure compliance with legal requirements and employee preferences.

Should You Outsource Payroll Management?

One of the biggest decisions businesses face is whether to handle payroll in-house or outsource it to a third-party provider. Outsourcing payroll can offer several advantages, such as reducing administrative burden and ensuring compliance with complex regulations. Many businesses choose this option to focus on core operations while leaving payroll management to experts.

However, outsourcing payroll isn't always the right choice for every business. Some companies prefer to maintain control over their payroll processes, ensuring that sensitive employee data remains secure. Additionally, outsourcing can come with costs that might not be feasible for smaller businesses. So, when deciding whether to outsource payroll, businesses must weigh the pros and cons based on their specific needs and resources.

What Tools Can Help Simplify Payroll?

In today's digital world, there are plenty of tools available to help businesses simplify payroll processes. Payroll software, for instance, can automate many of the tasks involved in managing employee compensation. These systems can handle time tracking, wage calculations, tax filings, and direct deposits, all in one place. By using payroll software, businesses can reduce the risk of errors and save time on manual processes.

Some popular payroll tools include QuickBooks, Gusto, and ADP. These platforms offer a range of features tailored to different business sizes and needs. For example, a small business might benefit from a simple, user-friendly interface, while a larger corporation might require more advanced features like multi-state tax compliance. So, choosing the right payroll tool is an important step in streamlining operations and improving efficiency.

Final Summary

Payroll meaning encompasses much more than just paying employees—it involves managing a complex web of financial obligations and ensuring compliance with legal requirements. From tracking work hours to handling deductions and benefits, payroll plays a critical role in maintaining a healthy and productive workforce. By understanding payroll meaning and implementing effective management strategies, businesses can create a transparent and reliable system for compensating their employees.

What Is Payroll? How to Properly Pay Your Employees

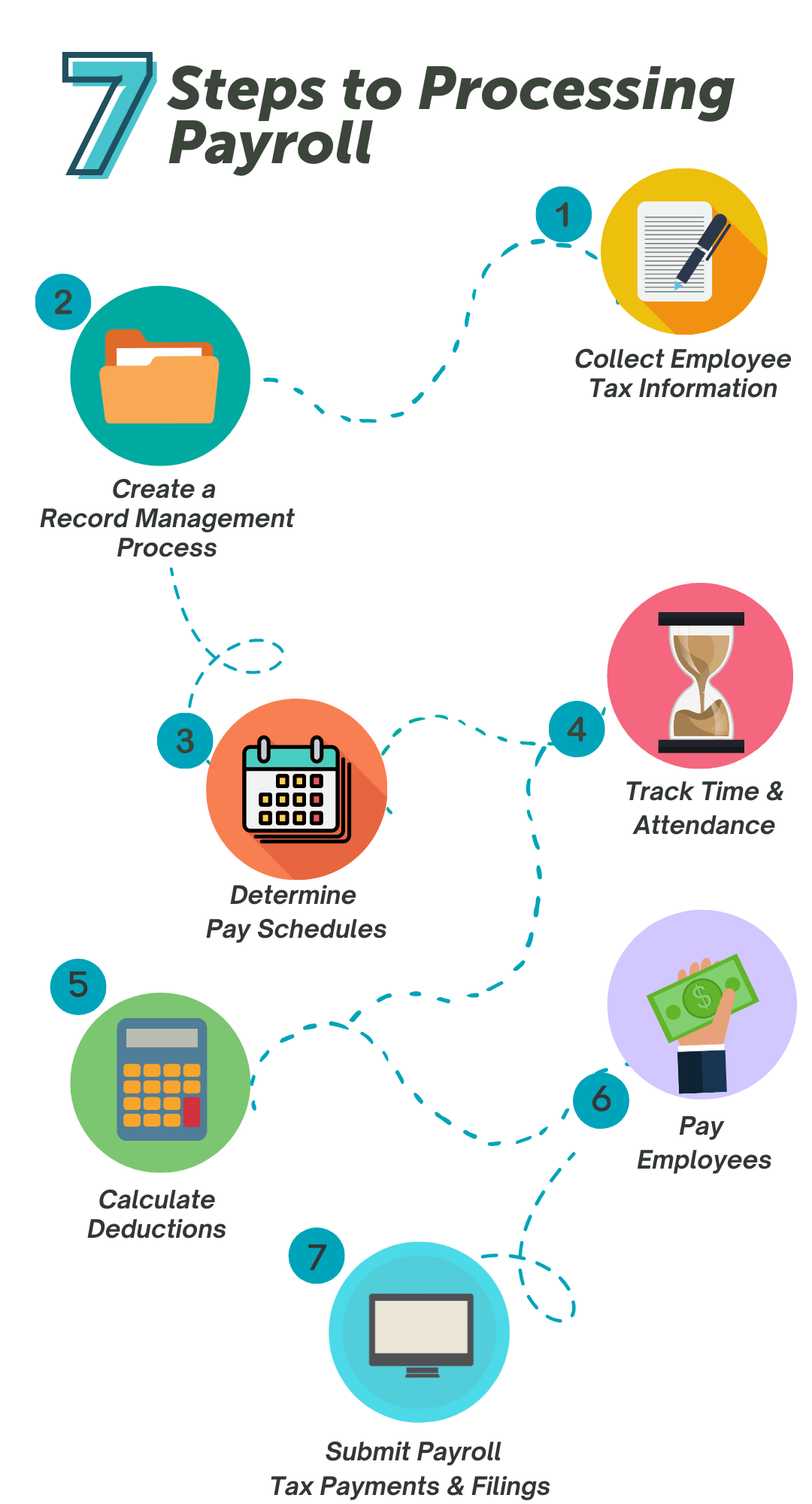

How to Process Payroll: A 7-Step Guide | APS Payroll

:max_bytes(150000):strip_icc()/payroll-4191484-3x2-final-1-008077377d4a4d36bec1424f414b0d9d.png)

What Is Payroll, With Step-by-Step Calculation of Payroll Taxes